2016 LTE Baseband Winners Announced: Intel, HiSilicon, MediaTek, Samsung LSI and Spreadtrum Gain Share reports Strategy Analytics

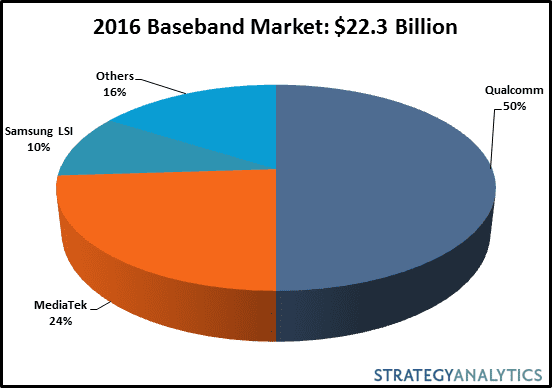

The global cellular baseband processor market grew 5 percent year-over-year to reach $22.3 billion in 2016, according to Strategy Analytics Handset Component Technologies service report, “Baseband Market Share Tracker 2016: Intel, MediaTek and Spreadtrum’s LTE Share Gains Cut into Qualcomm’s Lead.”

| 2016 Baseband Market: $22.3 Bn | ||

| Vendor | Revenue Share | |

| Qualcomm | 50% | |

| MediaTek | 24% | |

| Samsung LSI | 10% | |

| Others | 16% | |

Based on Strategy Analytics’ research, Qualcomm, MediaTek, Samsung LSI, Spreadtrum and HiSilicon grabbed the top-five baseband revenue share spots in 2016. Qualcomm, despite intense competition, maintained its baseband leadership with 50 percent revenue share, followed by MediaTek with 24 percent revenue share and Samsung LSI with 10 percent revenue share in 2016. LTE basebands registered a robust 36 percent year-over-year growth in 2016 while all other baseband segments declined sharply.

Sravan Kundojjala, Associate Director, commented, “Qualcomm continues to be the technology and market share leader in the baseband market and announced the world’s first gigabit-class LTE baseband chip and 5G baseband chip in 2016. Strategy Analytics estimates Qualcomm’s LTE unit share dropped to 52 percent in 2016 from 65 percent in 2015. Qualcomm couldn’t retain 100 percent baseband share in share in Apple’s new iPhone 7 and 7 Plus devices and lost some LTE baseband volume to Intel. Despite share losses, Qualcomm managed an impressive 8 percent year-over-year growth in its LTE shipments, thanks to strong traction for its Snapdragon applications processor line up. ”

According to Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies service, “MediaTek continued its LTE share gains in 2016 and more than doubled its LTE baseband shipments. MediaTek’s Helio P and non-Helio mid-range and entry-tier LTE products all gained good traction in emerging markets. In late 2016, MediaTek made inroads at Samsung Mobile but we estimate Samsung accounted for just 1 percent of MediaTek’s total LTE shipments. Despite impressive performance in 2016, MediaTek is likely to face challenges in 2017, owing to slow modem roadmap progress.”

Christopher Taylor, Director of the Strategy Analytics RF & Wireless Components service, added, “Intel’s LTE baseband shipments quadrupled year-over-year in 2016, helped by Apple iPhone design-wins. Strategy Analytics estimates Intel holds a bigger share of iPhone 7 and 7 Plus volumes than Qualcomm. Strategy Analytics notes that,HiSilicon, Samsung LSI, and Spreadtrum also registered strong LTE shipment growth in 2016.”

About Strategy Analytics

Strategy Analytics, Inc. provides the competitive edge with advisory services, consulting and actionable market intelligence for emerging technology, mobile and wireless, digital consumer and automotive electronics companies. With offices in North America, Europe and Asia, Strategy Analytics delivers insights for enterprise success.www.StrategyAnalytics.com