Focus on capturing capabilities to capitalize on automotive industry trends related to connectivity, electrification, autonomy, infotainment and mobility services

The ability to create a credible gap between rivals through acquisition will be increasingly difficult for automotive semiconductor vendors with the market share ROI (return-on-investment) from M&A (merger and acquisitions) effectively coming to an end. The Strategy Analytics Powertrain Body Chassis and Safety (PBCS) service report, “From Supply Chain to Value Network – the Changing Face of Automotive Competitive Landscape Dynamics (http://sa-link.cc/1pV),” analyzes the largest and most significant mergers and acquisitions in the automotive industry, with particular focus on semiconductor vendors, as well as looking at some of the major Tier 1 activity.

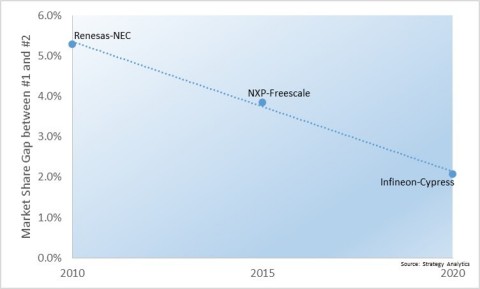

The Renesas-NEC merger started the last decade, allowing Renesas Electronics to command the top spot for several years before NXP’s acquisition of Freescale changed the rankings in 2015. Moving into the next decade, Infineon’s acquisition of Cypress will again change the rankings at the top. With each of these deals, the resulting entity has been able to leapfrog rivals to the number one spot, but the ability to create a credible gap between rivals through acquisition will be increasingly difficult as the market share ROI from M&A exercises drops to zero.

“We shouldn’t expect the current round of M&A activity, e.g. ADI buying Maxim, to result in a demonstrable shift in the top tier of automotive semiconductor vendor share rankings.” notes Asif Anwar , report author and PBCS Service Director. “They do validate a focus on capturing capabilities to capitalize on automotive industry trends related to connectivity, electrification, autonomy, infotainment and mobility services,”

Mr. Anwar continued, “The transformation from an automotive supply chain to a value network is evidenced by OEMs (Original Equipment Manufacturers) looking to work directly with companies that can provide strategically vital capabilities, and this will be the focus for future M&A activity. Whether the transformation from an automotive supply chain to a value network becomes a permanent fixture will dictate which future partnerships, mergers, acquisitions and divestments create the next major seismic shift in the automotive competitive landscape.”

KILL IT WITH FIRE’S LAUNCH DATE WILL BE AN UNLUCKY DAY FOR SPIDERS EVERYWHERE…