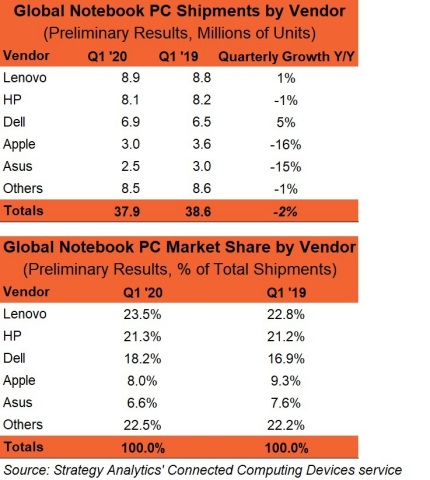

Dell grows 5%, Lenovo grows 1%; Apple and Asus shrink by double-digits as global notebook market contracts by -2%

The first quarter of 2020 proved to be very difficult for many industries but the notebook market escaped the worst of the initial downturn due to the COVID-19 outbreak. According to Strategy Analytics’ newest report, the notebook market shrank by only -2% year-on-year in Q1 2020. Even bigger challenges lie ahead as depressed consumer demand spreads across the world in Q2, leaving top notebook vendors in a precarious situation.

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, Preliminary Global Notebook PC Shipments and Market Share: Q1 2020 Results can be found here: https://www.strategyanalytics.com/access-services/devices/tablets-and-pcs/connected-computing-devices/market-data/report-detail/preliminary-global-notebook-pc-shipments-and-market-share-q1-2020-results-070520

Chirag Upadhyay, Senior Research Analyst added, “Notebook vendors with a heavy reliance on China for its supply chain and those which did not have high levels of inventory before the COVID-19 outbreak had most difficulty in Q1 on a global basis. From a consumer demand standpoint, the vendors which are most reliant on the Chinese domestic market experienced the biggest downturns. All of that aside, the notebook market only shrank -2% year-on-year and compared to most other consumer electronics segments, this should be considered a success in a very tough environment.”

Eric Smith, Director – Connected Computing said, “We expect that as COVID-19 spreads globally in Q2, large corporations and educational institutions will place more orders for notebooks to support work/learn-from-home initiatives around the world. As more families are stuck in their homes during quarantine orders, there are too few productivity devices for all members of a household to get their work done. Consumer demand will be soft as average people face economic hardship, but commercial demand could balance out that softness.”

Exhibit 1: Notebook Market Beat Gloomy Expectations in Q1 20201

| Global Notebook PC Shipments by Vendor (Preliminary Results, Millions of Units) | |||||

| Vendor | Q1 ’20 | Q1 ’19 | Quarterly Growth Y/Y | ||

| Lenovo | 8.9 | 8.8 | 1% | ||

| HP | 8.1 | 8.2 | -1% | ||

| Dell | 6.9 | 6.5 | 5% | ||

| Apple | 3.0 | 3.6 | -16% | ||

| Asus | 2.5 | 3.0 | -15% | ||

| Others | 8.5 | 8.6 | -1% | ||

| Totals | 37.9 | 38.6 | -2% | ||

| Global Notebook PC Market Share by Vendor (Preliminary Results, % of Total Shipments) | |||||

| Vendor | Q1 ’20 | Q1 ’19 | |||

| Lenovo | 23.5% | 22.8% | |||

| HP | 21.3% | 21.2% | |||

| Dell | 18.2% | 16.9% | |||

| Apple | 8.0% | 9.3% | |||

| Asus | 6.6% | 7.6% | |||

| Others | 22.5% | 22.2% | |||

| Totals | 100.0% | 100.0% | |||

| Source: Strategy Analytics’ Connected Computing Devices service |

Terraforming Earth Environment Update Out Now on Steam