High-Capacity Multi Chip Package Memory Drive Shipments

According to the latest research from Strategy Analytics, the global smartphone memory market clocked a total revenue of $11.4 billion in Q1 2021.

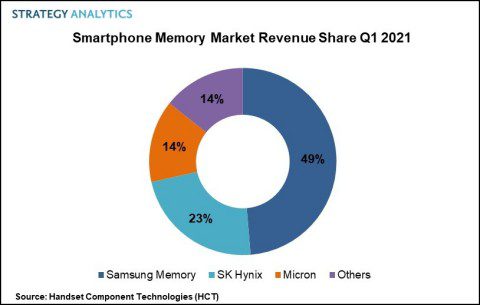

The research states that Samsung Memory led the smartphone memory market with 49 percent (DRAM & NAND) followed by SK Hynix and Micron in Q1 2021 as per Strategy Analytics Handset Component Technologies research report, “ Smartphone Memory Market Share Q1 2021: Samsung Memory Captures Top Spot .”

Samsung Memory , SK Hynix and Micron captured more than 80 percent revenue share in the global smartphone memory market in Q1 2021.

NAND Market

In Q1 2021, the smartphone NAND flash market witnessed 18 percent year-over-year growth in revenues driven by the adoption of UFS NAND flash chips, especially in mid and high-tier devices. Samsung Memory claimed the top spot with a revenue share of 42 percent followed by SK Hynix with 20 percent and Kioxia with 19 percent share in the smartphone NAND market in Q1 2021.

DRAM Market

The smartphone DRAM memory chip revenue observed an annual revenue growth of 21 percent in the quarter owing to the increase in new 5G device launches by smartphone customers. Samsung Memory led in terms of market share, capturing a revenue share of 54 percent followed by SK Hynix and Micron each having 25 percent and 20 percent respectively in the smartphone DRAM market in Q1 2021.

Jeffrey Mathews, Senior Analyst at Strategy Analytics said, “The recovery in the smartphone end-market resulted in early customer orders for memory vendors who shipped high-density memory chips to some of the key smartphone models. Samsung Memory, SK Hynix and Micron all gained share aided by the shipment of high capacity Multi Chip Package (MCP) based memory solutions. We note that UFS Multi Chip Package (uMCP) unit share reached nearly 30 percent driven by the shipment 128GB NAND and 6GB DRAM memory configurations in the quarter.”

According to Stephen Entwistle, Vice President of the Strategy Analytics Strategic Technologies Practice, “The strong demand for 5G smartphones creates a tailwind for the smartphone memory market growth. Memory vendors are expected to cater to the 5G demand with the introduction of high capacity UFS 3.1 and LPDDR5 Multi Chip Package memory solutions. However, the ongoing non-memory component shortages could dampen the memory market prospects.”