Arlo, Wyze, Nest, and Alarm.com Rounded Out the Top 5 in 2021

In 2021 Amazon’s Ring retained the global market camera share crown, building even more on the momentum it established in 2020 with an expanded camera portfolio, according Strategy Analytics’ report, “Smart Home Surveillance Camera Global Market Shares – June 2022”.

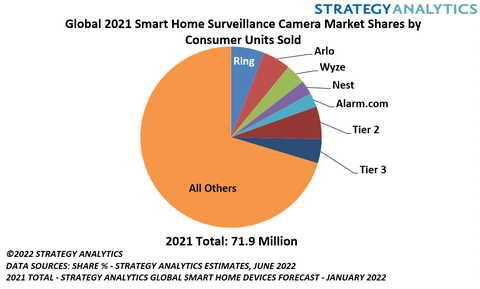

Global 2021 Smart Home Surveillance Camera Market Shares by Consumer Units Sold, Source: Strategy Analytics’ Global Smart Home Forecast, 2022

Strategy Analytics reports the top five home security camera brands globally as of the end of 2021 are, in order: Ring, Arlo, Wyze, Google’s Nest, and interactive security platform provider Alarm.com. These five companies combined to ship more than 14 million cameras, or about 20 percent, of the 72 million cameras Strategy Analytics estimates shipped to consumers globally in 2021. The report assesses the market for indoor and indoor/outdoor cameras sold to consumers, excluding video doorbells and professional surveillance systems. Retail-heavy Tier 2 companies D-Link, Eufy, EZVIZ, and Xiaomi were joined by ADT to round out the top 10. Tier 3 brands showcased the various go-to-market strategies that are in play in global surveillance camera market, whether through consumer electronics retailers (Kasa, Blink) or through interactive security channels (Resideo, SimpliSafe, and Vivint).

Overall smart home camera sales growth year-to-year roared back in 2021 as APAC brands with inexpensive, entry-level cameras jumped at opportunities to earn smart home customers as consumers got more familiar with surveillance cameras and pandemic-related installation restrictions eased for US interactive security providers. Nearly all brands recorded year-to-year unit shipment gains, though market shares for nearly all brands declined year-to-year as dozens of new brands flooded the market, especially in APAC.

Jack Narcotta, Principal Industry Analyst in Strategy Analytics’ Smart Home Strategies advisory service, said, “Ring’s brand strength in video doorbells continues to have a huge halo effect on Ring’s indoor and indoor/outdoor cameras, setting the stage for Ring to remain on top of the leaderboard at least for the next two years. However, brands that compete primarily in the US, like Ring, Nest, and Wyze, are fast approaching an inflection point after which their business model will need to adapt to incentivize add-on camera sales or upgrades to older models. The bulk of new customers are being earned outside the US, particularly in APAC where the number of brands with inexpensive cameras has climbed exponentially over the last two years.”

Bill Ablondi, Director of Strategy Analytics’ Smart Home Strategies advisory service, added, “The Midrange price segment, which includes cameras priced between $50 and $100, is emerging as the main competitive arena. This price band will provide most brands with a balance of profits and revenue that makes competing in this segment a sustainable effort. Interactive security providers such as ADT, Alarm.com, and Vivint will eventually control most of the Premium price band as they develop sales and marketing campaigns to increase the number of cameras included sold to new subscribers and entice add-on camera purchases from their existing subscribers.”

Distributed Cloud: The Priority Tech Trend and What This Means for Businesses