A survey conducted by the Brazil Games export program – a partnership between Abragames and ApexBrasil (Brazilian Agency for Promotion of Exports and Investments) – presents a mapping of national game development companies by region, technologies used, diversity, production capacity, revenue sources, among other segments

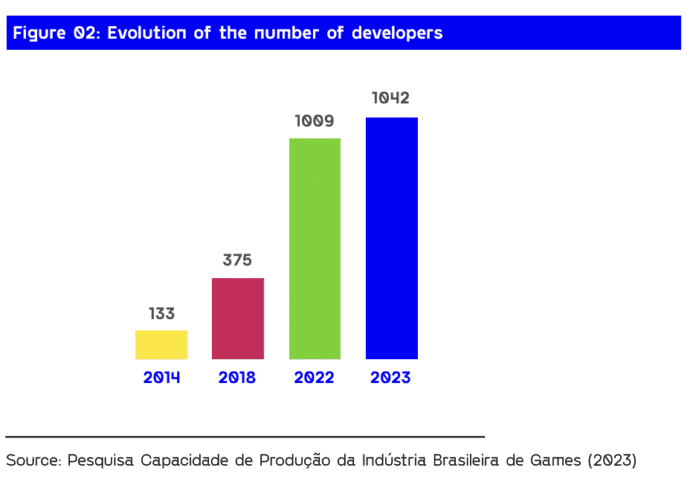

| Abragames (Brazilian Association of Digital Game Developers) has just officially launched the 2nd National Survey of the Game Industry, a study developed in partnership with ApexBrasil (Brazilian Agency for Promotion of Exports and Investments), carried out through the Brazil Games export project. Among other points, the data for the years 2022 and 2023 reveals a growth of 3.2% in the total number of national studios, which increased from 1,009 in 2021 to 1,042. The positive result is supported by the number of proprietary games developed between 2020 and 2022, which reached 2,600. Among these, 1,009 were released in 2022 alone, marking a 12% increase compared to 2021, the period covered in the first edition of the survey. Regarding industry professionals, there was also an increase, this time of 6.3%, rising from 12,441 to 13,225. “The data presented in the second edition of the survey also reinforces Brazil’s position as one of the most promising regions for providing External Development services, as had already been indicated in the reports of the XDS Summit, a global reference on the subject,” highlights Rodrigo Terra, president of Abragames. “The work done by Brazilians has been meeting international demands with quality and standing out, among other aspects, for artistic, engineering, and co-dev issues. As a result, we have half of Brazilian developers operating in other markets with more than 70% of their revenues coming from various countries.” The growing maturity of the Brazilian industry is also evident in other segments of the survey. Among them, it stands out that in 2022, 93% of national studios developed their own intellectual property (IP). “Currently, the projects from our studios are on par with those of the same size from any other part of the world. There is still a clear difference in investment, but not due to a capacity issue. From 2021 to 2022, for example, it was observed that the participation of national studios in transmedia projects (15%) and licensing their own IPs (13%) surpassed the involvement in licensing third-party products (10%) – which represented 18% in 2021,” evaluates Terra. The president of Abragames also highlights the evolution of the numbers since 2014, when the first analysis of the segment was conducted. Since then, Brazil has gone from 133 game development studios to 1,042, an increase of almost eight times. In just the last five years, this same segment has grown by 177%, as in 2018, only 375 companies were developing games in the country. The methodology of the research and the transparency of the data The main objective of the second edition of the survey is to comprehensively map the current state of the digital gaming ecosystem in Brazil, considering the entire year of 2022 and comparing it with the previous study, which analyzed the market in 2021. Given the constant innovations in the sector and aiming to maximize the reach of the study, the data collection and analysis period took place throughout the year 2023. The survey in 2023 was conducted by GA Consulting, which continued the work of the first edition of the research. The new study, like the previous one, used a mixed methodology, with a primary focus on mapping and questionnaires. To achieve this, bibliographic references and the knowledge already gathered and structured in the previous year were utilized. “The second edition of the research is the result of hard work over the past two years. In addition to the natural challenges of a study of this magnitude, mapping the digital gaming industry in Brazil adds other barriers that should be noted for a better understanding of the report and its use for decision-making: the first is the lack of a specific CNAE (National Classification of Economic Activities) for game development companies, and the second is the dynamism of the sector, which has few barriers for new entrants,” explains Marcos Vinicius Cardoso, co-founder of GA Consulting. For a studio to participate in the survey, it was necessary to meet at least one of the following criteria: be a member of a specific regional association or collective of digital game developers; have responded to the survey questionnaire; have a company website and/or social media activity in the years 2021/2022; have released a game in the year 2021/2022; have a company with an active game and revenue measured by the AppMagic platform; have an active CNPJ (National Register of Legal Entities) and main CNAE (National Classification of Economic Activities) consistent with game development activity; have confirmed receipt of the survey through a phone call; have one or more games with updates in 2021/2022/2023; have a Google account with indication of the company’s operating hours; have a product participating in the “MADE IN BRAZIL SALE 2023” on the STEAM platform. In the current survey, 309 companies responded proactively to the questionnaire as developer studios, marking an increase of approximately 39% compared to the previous year (223 companies). Additionally, 34 studios responded to the questionnaire as sole proprietors (as individual companies), bringing the total to 343 respondents among the considered active companies – or 33% of those mapped. It is also worth noting that since not all companies responded to all the survey questions, the number of responses may vary for each question, and thus the study always indicates the number of responses in each graph. Studios’ Demographics |

|

| The 2nd National Survey of the Game Industry reveals that national game development studios are distributed across almost all states of the federation, but the highest concentration continues to be in the states of the South and Southeast. This historical polarization is mainly due to the emergence of the first game design and digital game development courses in these regions, as well as the entire creative ecosystem present in their main cities. Out of the 1,042 companies mapped in the survey, 861 are divided regionally, with São Paulo (302), Rio de Janeiro (107), and Rio Grande do Sul (69) having the highest presence. In terms of regions, 56% of the studios are concentrated in the Southeast, 20% in the South, 16% in the Northeast, 6% in the Midwest, and 2% in the North. “The demographic survey of the studios is very similar to what was found in the previous research, indicating stability for the coming years,” analyzes Marcos Vinícius. “As a new feature, the current survey presents the division of studios by city. In this aspect, municipalities with a more prominent cultural and creative presence also stand out as development hubs,” adds the co-founder of GA Consulting. Gender, Diversity, and Quality The survey also indicates that despite the significant number of layoffs in the largest companies in the sector during the year 2022, it is estimated that 784 individuals started working at Brazilian game development studios, raising the total from 12,441 professionals in 2021 to 13,225 the following year. Regarding gender, the collected data indicates that men are the most represented within the development studios, whether as partners or employees, totaling 74.2% of the human resources among the respondents. The number of women decreased from 29.8% in 2022 to 24.3%, while the number of non-binary individuals remained at 1.5%. One explanation for the reduction in the number of women between the two years is the sampling effect, as the responding companies in the two surveys are different. On the other hand, in the breakdown of partners’ distribution by area and gender in the development studios, women appeared ahead of men in one sector for the first time: the administrative/financial sector, with 28% compared to 24%. It is also worth noting that more than half of Brazilian companies (57%, the same as in the 2022 survey) claim to have a diverse workforce, including transgender individuals, people over 50, foreigners, refugees, people with disabilities, black, mixed-race, or indigenous individuals. Strong International Presence With an increasing number of qualified professionals and significant achievements in the international market, the Brazilian industry has been reaping significant rewards in recent years. In 2023, for example, Brazil was honored by gamescom, one of the largest gaming events in the world held annually in Cologne, Germany, which publicly acknowledged the maturity and quality of Brazilian developers For Brazilian exporting companies, the United States and countries in Latin America represent the main commercial markets. During the survey period, these countries did business with 58% and 57% of Brazilian studios with this profile, respectively. The result reflects growth of 3% and 4%, respectively, compared to the previous survey. On the other hand, Western Europe was the region with the highest percentage growth, jumping from 49% to 54%. Half of the national developers operating in the international market obtained more than 70% of their revenue directly from abroad. When considering only studios with primary revenue coming from outside the country, the number of developers rises to 65%. Technological Preferences Currently, among national studios, 80% of respondents use the Unity game engine in their projects – in the previous survey, this segment was at 83%. Following that, the usage of the Unreal Engine, developed by Epic Games, has increased its presence from 23% to 25% – being the only one to have recorded growth among all the engines surveyed. Another interesting data point reflecting the versatility of Brazilians is that, on average, local studios used 1.5 engines in their productions, with 8% of developers opting for three or more platforms. Production Capacity The services offered by Brazilian studios to third parties did not undergo significant percentage changes compared to the survey published in 2022 but remain prominent. In the current study, the major novelty lies in the search for partners for services related to User Interface/User Experience, which grew from 21% to 26%, and to Level Design/Construction, which increased from 25% to 32%. “Brazil is experiencing a growing and increasingly diversified productive scenario. It’s impressive how international companies have been interested in the work developed in Brazil and have been recognizing our talents in various roles,” points out Eliana Russi, COO of Abragames and responsible for managing Brazil Games. “Over the past few years, we have seen international business grow during in-person events worldwide, and the eyes of players from different continents are certainly focused on our professionals.” Industry Revenue |

|

| Based on the premises used in mapping the companies and, especially, in the possibility of comparison with the years 2015 and 2018, the second edition of the survey presents a new method for calculating the revenue of the national game industry. While the previous model only considered the revenue of developers serving the consumer and entertainment market, the current one takes into account games and services developed for third parties, educational games, advergames, etc. Thus, it is estimated that in 2022, the revenue of the game development industry in Brazil was $251.6 million USD. When comparing the results of the two most recent surveys, it is observed that in the current one, 60.4% of companies have revenue of up to R$ 360,000, compared to 65% in the 2022 survey. The biggest difference occurs in the revenue range of up to R$ 81,000, which decreased from 39% to 33.3%. On the other hand, the revenue range between R$ 360,000 and R$ 1.8 million increased from 23% to 27.7%, reinforcing the trend detected in 2022 that developers are in a process of maturation and have greater exposure to the international market. Regarding revenue sources and types of monetization, it is noteworthy that revenue from the sale of games via digital platforms increased from 54% in 2021 to 62% in 2022. Meanwhile, direct sales decreased from 30% to 23% over the same period. Following this, microtransactions (20%), private commissions (17%), and advertising (16%) are observed. In terms of game types, entertainment games lead by a wide margin (83%), followed by educational games (8%) and advergames (3%). Finally, when considering the platforms that generated the highest revenue, the majority of companies indicated computers (44%), followed by mobile devices (23%) and consoles (12%). Game Development by Platform The distribution of games developed by platform showed one of the main changes compared to the previous survey. In the study published in 2022, games for mobile devices were clearly leading (39%), followed by PC games (21%). In the new study, PC games took the lead with 24.9% preference, just slightly ahead of mobile games, which accounted for 24%. Another relevant factor is the continuous growth in the production of games for consoles, as already noted in the 2022 survey. The production, which reached 5% in 2018, rose to 17% in 2021 and 19% in 2022. There was an even greater highlight for handheld consoles, which doubled compared to the previous year, reaching 4%. Trends and Remote Work System The significant attention given in recent years to new technological possibilities related to Generative Artificial Intelligence (AI) has overshadowed some trends reported in the previous survey, such as blockchain, virtual, augmented, or mixed reality (XR), and the metaverse. About half of the respondents mentioned or commented on AI as a trend, both in the short and long term. Additionally, similar to 2022, among the top market trends indicated by respondents are cloud gaming, subscription-based models, and the acceptance and utilization of remote work with companies from different countries. The research shows that 70% of Brazilian companies work in a home office system, followed by 16% operating in a hybrid regime and only 14% in-person. As a result, this scenario has opened doors and accelerated the process of experienced professionals leaving for the international market, as hiring no longer faces physical barriers of relocation. Consequently, retaining top professionals in the country becomes more challenging, as foreign companies often offer more financial incentives to their employees. Expectations for the Next Years In recent months, large international game development companies, including some of the largest Brazilian ones in the sector, have experienced periods of layoffs and dismissals. Regarding the impact of this moment, which occurred after the period of the current survey, Rodrigo Terra reflects: “We are going through a new moment, as there is a post-pandemic reorganization of companies and market expectations are still relative. However, there are prospects for improvement in the Brazilian economy, supported by a more stable political environment, contrasting with the instability of the global market. We believe in a future with potential opportunities and many challenges, where Brazil can stand out with an ecosystem that has been growing and diversifying more and more.” |

Tiger Blade ‘Challenges Update #1’ available now for Quest, more coming soon