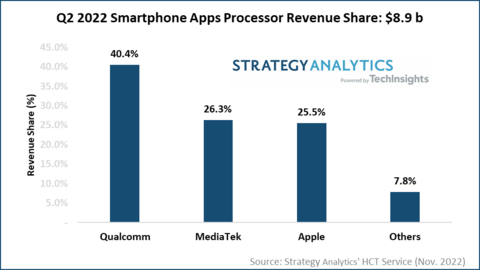

The global smartphone applications processor (AP) market grew 26 percent to $8.9 billion in Q2 2022, according to Strategy Analytics’ Handset Component Technologies (HCT) service report.

Q2 2022 Smartphone Apps Processor Revenue Share: $8.9B (Source: Strategy Analytics’ Handset Component Technologies Service, November 2022) (Graphic: Business Wire)

Strategy Analytics’ research report “Smartphone Apps Processor Market Share Tracker Q2 2022: Qualcomm Posts All-time High ASPs” estimates that Qualcomm, MediaTek, Apple, Samsung LSI and Unisoc captured the top-five revenue share rankings in the smartphone applications processor (AP) market in Q2 2022.

- Qualcomm maintained its lead in the smartphone AP market with a 40 percent revenue share, followed by MediaTek with 26 percent and Apple with 25.5 percent.

- 5G-attached AP shipments accounted for 55 percent of total smartphone APs shipped in Q2 2022.

- TSMC manufactured over 80 percent of smartphone APs shipped in Q2 2022. Samsung Foundry’s key customer Qualcomm shifted orders to TSMC in recent quarters.

- Google and JLQ Technologies (a Leadcore and Qualcomm JV) shipped over a million APs in Q2 2022.

Sravan Kundojjala , author of the report and Directorof Handset Component Technologies service at Strategy Analytics, commented, “Qualcomm‘s smartphone apps processor (AP) revenue grew 41 percent in Q2 2022 despite a 23 percent shipment decline. Qualcomm’s momentum in premium-tier Android APs helped. The Samsung Galaxy S22 design win fueled Qualcomm’s AP ASPs to an all-time high. Despite traction in the premium tier, Qualcomm will likely face inventory correction headwinds in 2H 2022. Samsung LSI‘ Exynos smartphone AP shipments declined 46 percent year-on-year but showed signs of recovery with traction in mid-range.”

Mr. Kundojjala continued, “MediaTek posted its all-time high quarterly AP revenue in Q2 2022, driven by a high mix of high-end and premium tier Dimensity 5G APs. The company, however, will see a decline in its AP shipments and revenues in 2H2022 due to continued Android weakness in China. Unisoc, on the other hand, posted a 26 percent shipment growth in Q2 2022, thanks to continued traction in tier-one 4G smartphones.”

A CINEMA EXPERIENCE: PRIVATE GAMING COMPETITIONS IN CINESA CINEMAS