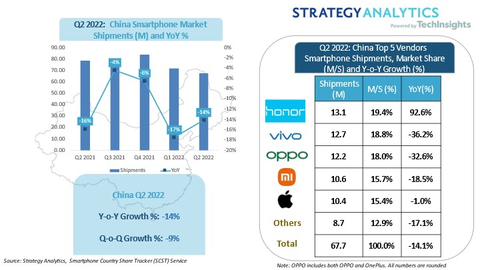

Honor Topped China Smartphone Market for First Time Ever in Q2 2022

According to new research from Strategy Analytics, China smartphone shipments fell -14% YoY to 67.7 million units in Q2 2022, blaming to the COVID lockdowns and disruptions. Honor becomes the largest smartphone vendor with an impressive 19% share in Q2 2022, for the first time ever. vivo, OPPO (including OnePlus), and Xiaomi and Apple followed in the top five list.

China Smartphone Shipments & Marketshare in Q2 2022. (Graphic: Business Wire)

Yiwen Wu, Senior Analyst at Strategy Analytics, said, “China smartphone shipments dropped to 67.7 million units in Q2 2022, down -14% YoY. It has been the worst second quarter performance since 2013. The market takes a big hit from the covid-related lockdowns and restrictions, as well as macroeconomic headwinds.”

Linda Sui, Senior Director at Strategy Analytics, added, “The vendor’s ranking reshuffled this quarter amid the intensified competition in Android camp. Honor has replaced Huawei in China market. It captured the top position with 19% market share, up from 9% one year ago. This is the first time the company topped home market since the split from Huawei from 2021.It shipped 13.1 million units of smartphone shipments in China this quarter, significantly outperforming the overall market with an impressive +93% YoY growth rate. Honor’s resilient journey goes very well, thanks to the comprehensive product portfolio and the balanced online and offline distribution channel. Moreover, the relatively healthy inventory status also helped the company achieve the solid performance this quarter.”

Peng Peng, Analyst at Strategy Analytics, added, “vivo, OPPO, and Xiaomi followed with 12.7 million units, 12.2 million units, and 10.6 million units of shipments, respectively. All of them posted double-digit annual decline however, hitting badly by the unfavorable market conditions and the intensified competition from Honor. To tackle the challenges, they slowed down the product launch cycle and improved inventory management. In addition, vivo revisited its premium strategy and adjusted product lineup by replacing NEX series with expanded X series. OPPO lowered the launch price of new Reno 8 series and brought online-focused K10 series to the market. Xiaomi continued its brand uplift efforts. It announced the partnership with Leica and launched co-branded Mi 12s series targeting lucrative premium segment.”

Neil Mawston, Executive Directorat Strategy Analytics, added, “Apple ranked fifth with 10.4 million units of iPhone shipments this quarter. Apple was adversely impacted by Shanghai lockdowns in April and May but saw a strong rebound since June. Its shipment went down merely -1% YoY in Q2 2022 and it significantly outperformed the overall market. Meanwhile, Apple has become more engaged in China’s 618 online shopping festival this year. It dominated with 46% volume share and 66% revenue share, far ahead of Chinese brands, according to the research from Strategy Analytics.”

Yiwen Wu, Senior Analyst at Strategy Analytics, added, “We forecast China smartphone shipments to decline -10% to -11% YoY in full-year 2022. COVID-related disruption and macroeconomic headwinds will continue through end of 2022 and expect to steadily ease from second quarter of 2023. We expect Honor will continue to remain the strong momentum in China market during the second half of 2022, it has replaced Huawei in China market. Apple will stabilize the performance and see the healthy demand from the upcoming iPhone 14 series. It remains to be seen all responses and actions from Xiaomi, OPPO (OnePlus) and vivo will help them to stabilize the performance in home market in the following quarters.”

Source: Strategy Analytics, Inc.

ESports Premier League (ESPL) Season 2